is idaho tax friendly to retirees

The State of Idaho doesnt receive any property tax. Social Security income is not taxedWages are taxed at normal rates and your marginal state tax rate is 590.

The Most Tax Friendly States For Retirees Robert Powell Marketwatch Retirement Tax Money Management

Idaho is tax-friendly toward retirees.

. Idaho is tax-friendly toward retirees. What makes Idaho RETIREE-FRIENDLY. Withdrawals from retirement accounts are fully taxed.

Whats more Idaho is tax-friendly for retirees. Veterans can minimize how big a bite taxes take by choosing from states that dont tax military retirement. Use the instructions for.

New Look At Your Financial Strategy. This is why if you are a retiree with a fixed income you might prefer tax-friendly states. Find specific information relating to any retirement benefits youre receiving in the Instructions Individual Income Tax.

Property tax applies to all nonexempt property. However it is necessary to consider costs when finalizing retirement plans. Part 1 Age Disability and Filing status.

Ad Read this guide to learn ways to avoid running out of money in retirement. While potentially taxable on your federal return these arent taxable in Idaho. Taxes are inevitable in some form no matter if you are a civilian or military retiree or wherever you may live.

Social Security income is not taxed. Recommended as a Retirement Spot. File With Confidence Today.

Idaho does their taxes the EXACT way I prefer low property and sales tax and a bit higher on the income side. Notably Social Security income is not taxed. Ad Answer Simple Questions About Your Life And We Do The Rest.

Wages are taxed at normal rates and your marginal state tax rate is 590. Do Your Investments Align with Your Goals. Learn about how Idaho taxes retirement income the Food Tax Credit and the three ways to save money on your property taxes.

Visit The Official Edward Jones Site. Boise has a lot to offer from plentiful cultural amenities and safe neighborhoods to excellent medical facilities and a bounty of nearby outdoor recreation areas. Yes Is Idaho Tax-Friendly at Retirement.

Find a Dedicated Financial Advisor Now. Exemptions exist for some federal state and local pensions as well as certain Canadian OAS QPP and CPP benefits. Are property taxes high in Idaho.

Idaho allows for a subtraction of retirement income on your state return if the taxpayer meets both parts of the two-part qualification that the state requires. Obviously low for all three is ideal but the. Public and private pension income are partially taxed.

Learn about Idahos Medical Savings Account the Treasure Valleys hospitals and how an interstate move will affect your Medicare benefits. If you have a 500000 portfolio get this must-read guide by Fisher Investments. Since the housing market might be a detractor in your pro and con.

From Simple To Complex Taxes Filing With TurboTax Is Easy. The recipient of the retirement benefits must be at least 65 years old OR be classified as disabled and at least 62 years old.

Idaho Retirement Tax Friendliness Smartasset

The Crystal Gold Mine In Idaho Offers The Only Underground Mine Tour In The Northwest Idaho Travel Outdoors Adventure Summer Travel

7 States That Do Not Tax Retirement Income

Idaho Retirement Tax Friendliness Smartasset

States With Highest And Lowest Sales Tax Rates

Idaho Retirement Guide Idaho Best Places To Retire Top Retirements

Map Here Are The Best And Worst U S States For Retirement In 2020

Where To Retire Cover For 11 1 2019 Magazine Titles Magazine Subscription Autumn Park

18 Pros And Cons Of Retiring In Idaho 2020 Aging Greatly

21 Pros And Cons Of Retiring In Idaho Retirepedia

Idaho Retirement Tax Friendliness Smartasset

These Are The States With The Lowest Costs Of Living Retirement Locations Cost Of Living States In America

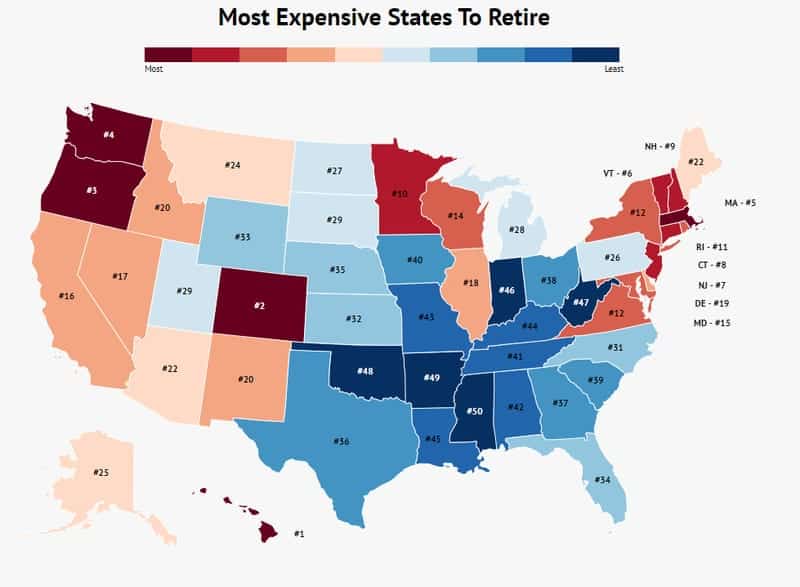

Don T Retire In These 10 States If You Want To Keep Your Money The Most Expensive States To Retire Zippia

Best And Worst States To Live In When Preparing For Retirement Preparing For Retirement States Retirement

Which States Pay The Highest Taxes Business Tax Family Money Saving Economy Infographic

Here S How Long 1 Million In Retirement Savings Will Last In Your State Saving For Retirement Best Places To Retire Map

37 States That Don T Tax Social Security Benefits The Motley Fool

How Much You Ll Need To Retire In The Most Expensive U S Cities Retirement Humor Retirement Money Choices